Overview

What is Pye

Pye is a protocol for managing and trading stake accounts on Solana. Pye allows validators to issue and manage stake accounts with custom commercial terms (eg. fixed, variable rewards), while providing stakers with a venue to trade them.

Background

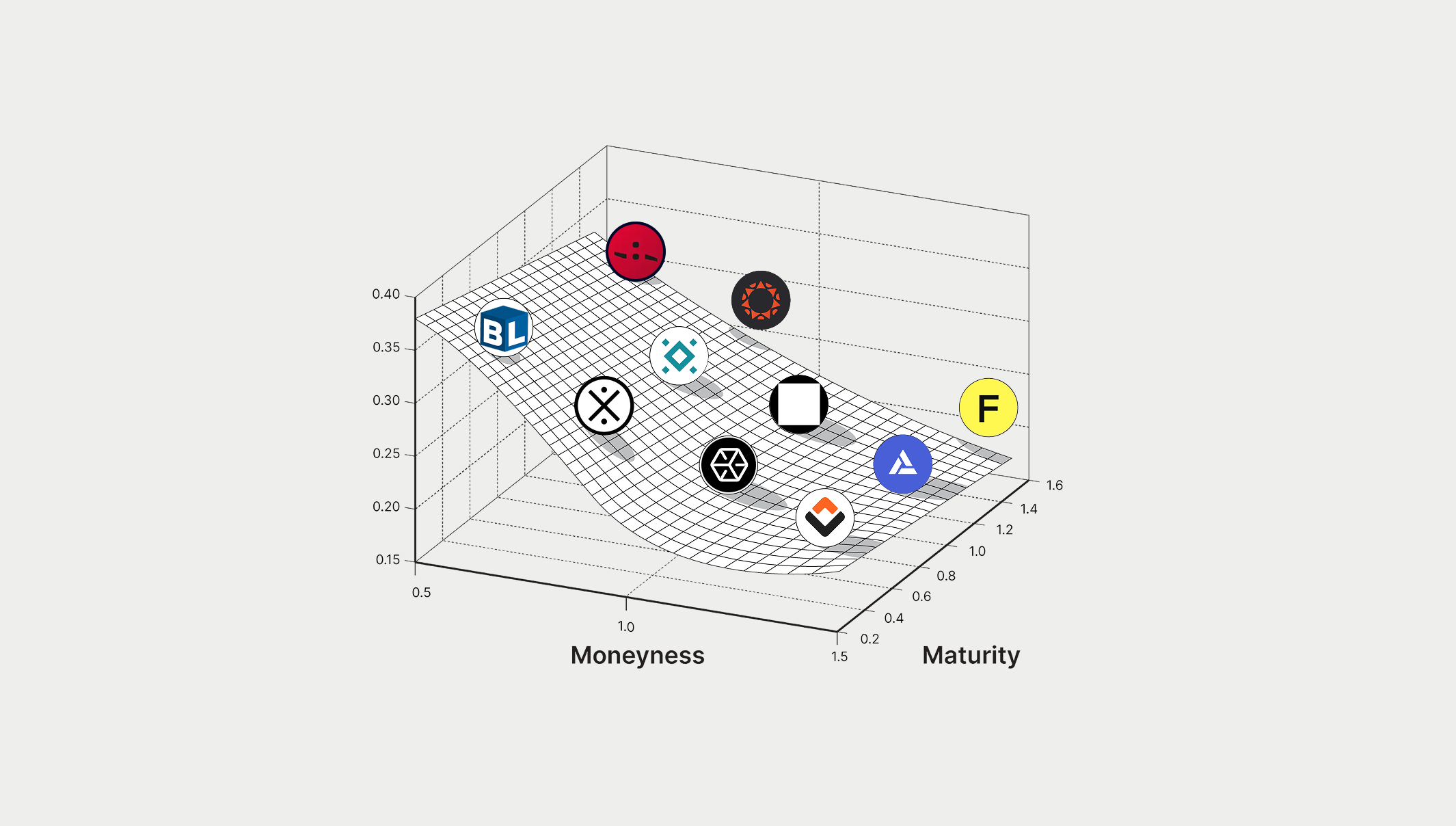

Following many discussions with validators on Solana we discovered Solana has a hidden yield curve. Validators had been sharing more MEV and block rewards in exchange for longer duration lockups. Pye's mission is to bring this behavior onchain and build a transparent market where validators and stakers can transact.

Benefits:

Stakers: Access to the best yield across all validators.

Validators: Manage staker relationships, attract TVL, predictable revenue.

Solana: Increase decentralization, yield discovery, levels the playing field for validators.

Primitive

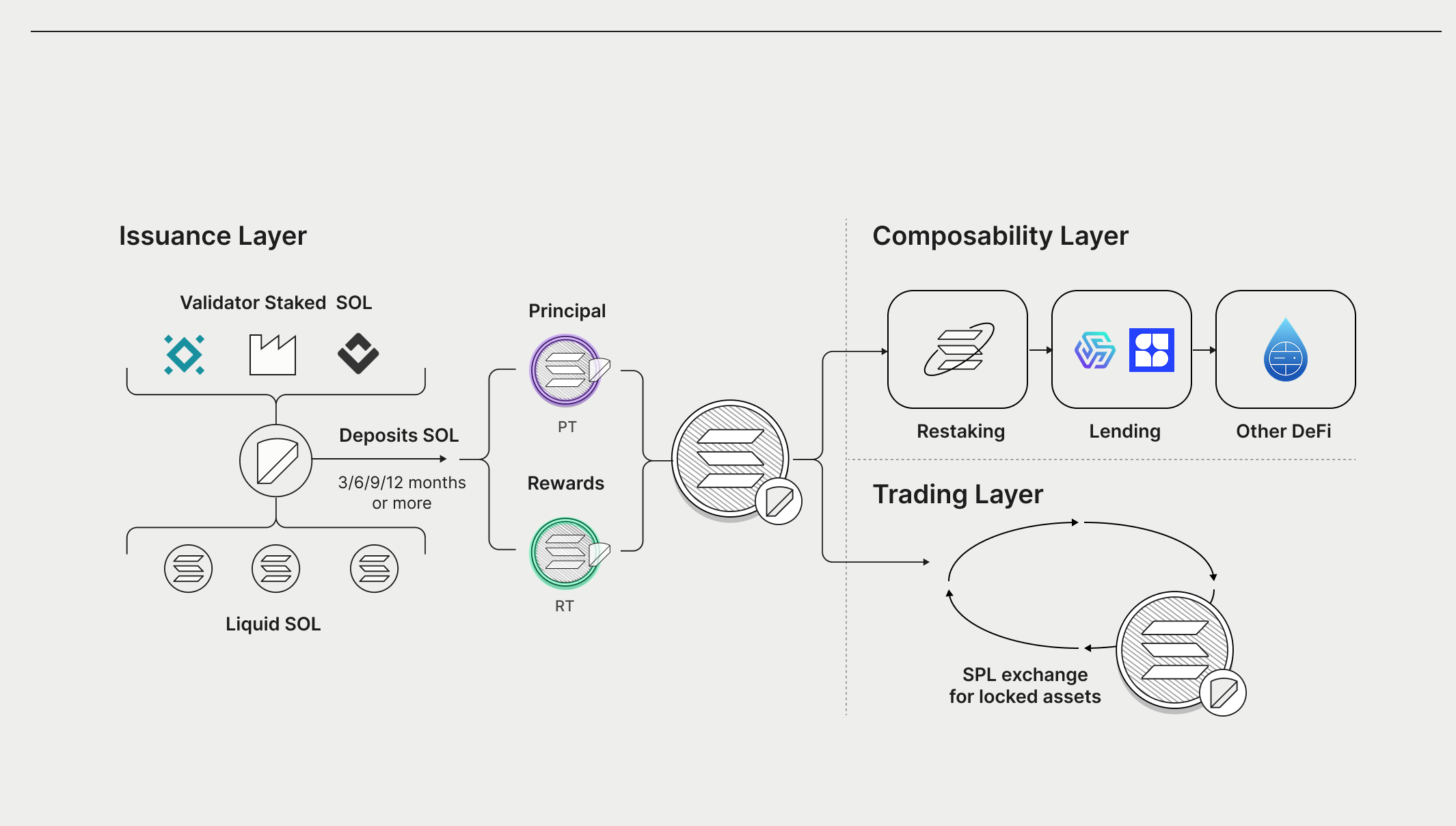

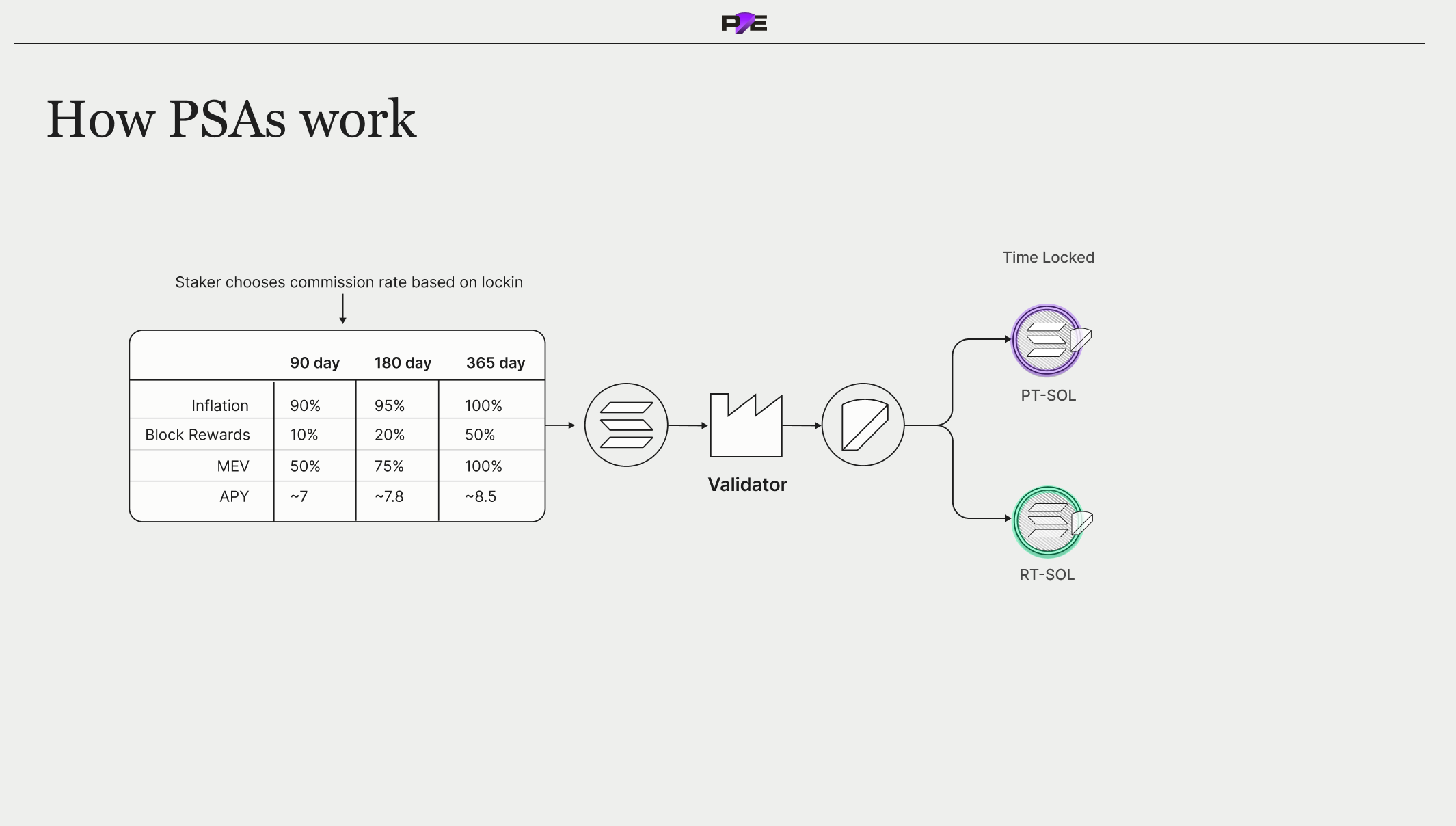

At its core, Pye is powered by Programmable Stake Accounts (PSAs) - a new staking primitive we designed that splits Solana native stake accounts into principal and reward components:

Principal Token (PT): A 1:1 representation of the deposit. Accrues no rewards.

Reward Token (RT): Redeemable for all the rewards accrued till maturity (inflation, block rewards, MEV).

Unlike price discovery protocols, this design decision was not explicitly made to enable fixed-rates but because we concluded this was a superior issuance format that allows for an entire design space to open up: structured products, rate swaps, fixed-rate AMMs, yield forwarding to mention a few.

Ecosystem

Pye was built on the insight that validators are willing to share more rewards (inflation, MEV, priority fees) with their delegators in exchange for longer lockups.

Our vision is to provide the Solana ecosystem with a drop-in replacement for Stake Accounts that grant validators granular control over their relationship with stakers. Along the way, we aim to pave the road for validator-centric DeFi ecosystem, where financial products such as yield trading, loans, and enhanced yield strategies are made available directly from the validator layer.