Validator Dashboard

The Validator Dashboard provides a complete view of your validator’s staking activity and lockups issuance through Pye. This page is only accessible to wallets that are authorized as issuers and org team members.

⚠️ Best Practices for Validators

Regularly check your issuer keys, only use trusted wallets for creating new lockups.

Use private lockups for agreements thats require custom structures.

Monitor capacity and TVL and consider opening new lockups when current ones are near full.

Usage

As a validator, the dashboard helps you:

Track the scale of deposits you are attracting through Pye.

Monitor active lockup states (open, closed, matured).

Verify that your issuer wallets are correctly set up for new lockup creation.

Provide transparent performance metrics (APY, reward sources, capacity) to depositors.

Manage both public offerings (open to all stakers) and private deals (customized issuance).

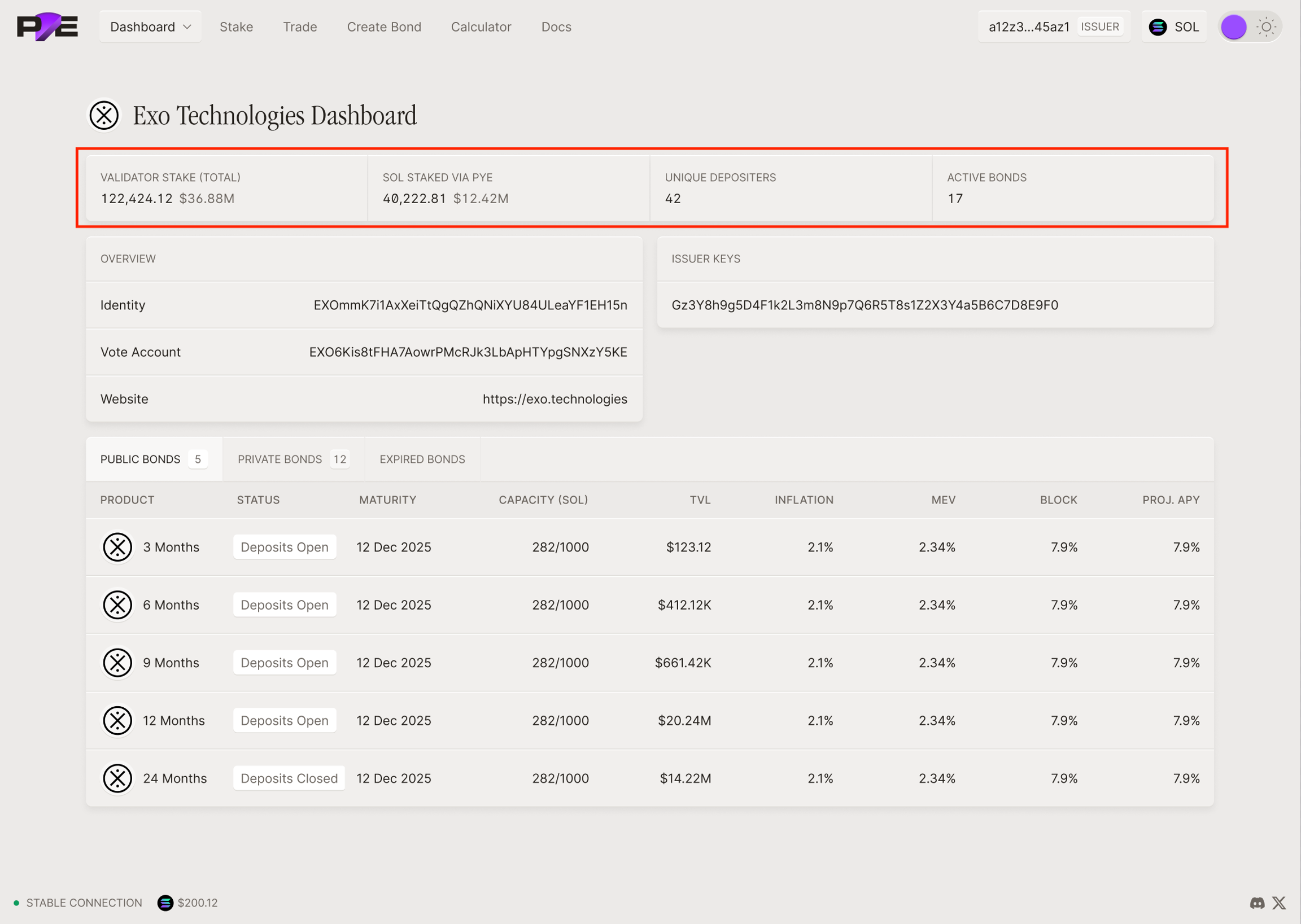

STEP 1: Key Metrics

At the top of the dashboard, you will find key validator statistics:

Validator Stake (Total) Displays the total SOL delegated to your validator, including both Pye-issued and non-Pye stake. Example:

122,424.12 SOL ($36.88M)SOL Staked via Pye Shows the portion of your total stake that entered through Pye-issued lockups. Example:

40,222.81 SOL ($12.42M)Unique Depositors The number of distinct wallet addresses that have deposited into your validator’s lockups.

Active Lockups The number of currently active lockups (both public and private) under your validator.

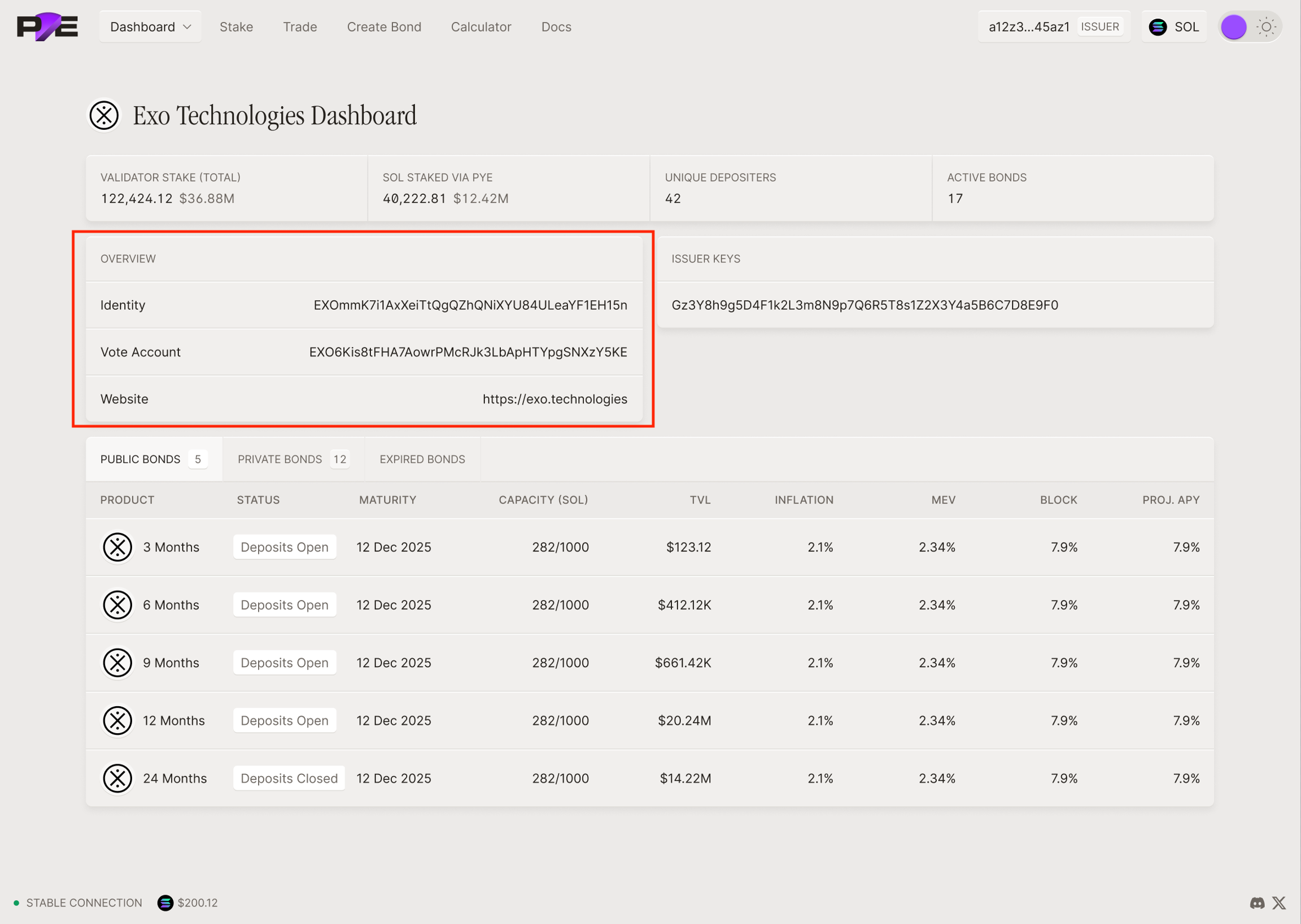

STEP 2: Validator Overview

This section contains the technical identifiers used to issue and verify lockups:

Identity The identity key of your validator node.

Vote Account The validator vote account tied to consensus and reward collection.

Website Public-facing link provided by the validator (optional).

Issuer Keys The wallet addresses authorized to issue new lockups (lockups) under your validator. These are the accounts that sign new issuance transactions.

STEP 3: Lockup Table

The dashboard separates lockups into three categories:

Public Lockup Lockups that are open to all depositors on app.pye.fi.

Private Lockup Lockups restricted to specific whitelisted wallets (e.g., OTC agreements or custom terms).

Expired Lockup Lockups that have matured and are no longer accepting deposits. These remain viewable for record-keeping and settlement tracking.

Each lockup is shown in a structured table. The columns include:

Product The term length of the lockup (e.g., 3 Months, 6 Months, 12 Months).

Status The current state of the lockup:

Deposits Open → Active and accepting deposits.

Deposits Closed → Not accepting new deposits, but still active until maturity.

Matured → Ready for redemption by stakers.

Maturity The date at which principal can be redeemed by depositors.

TVL (Total Value Locked) The dollar value of deposits currently held in the lockup.

Commission Structure Breakdown of the validator’s reward sources allocated to this lockup:

Inflation → Base staking rewards.

MEV → Priority fees and validator-extracted value.

Block → Block production rewards.

Proj. APY The projected annual percentage yield for depositors, based on the reward split and validator performance.

Last updated